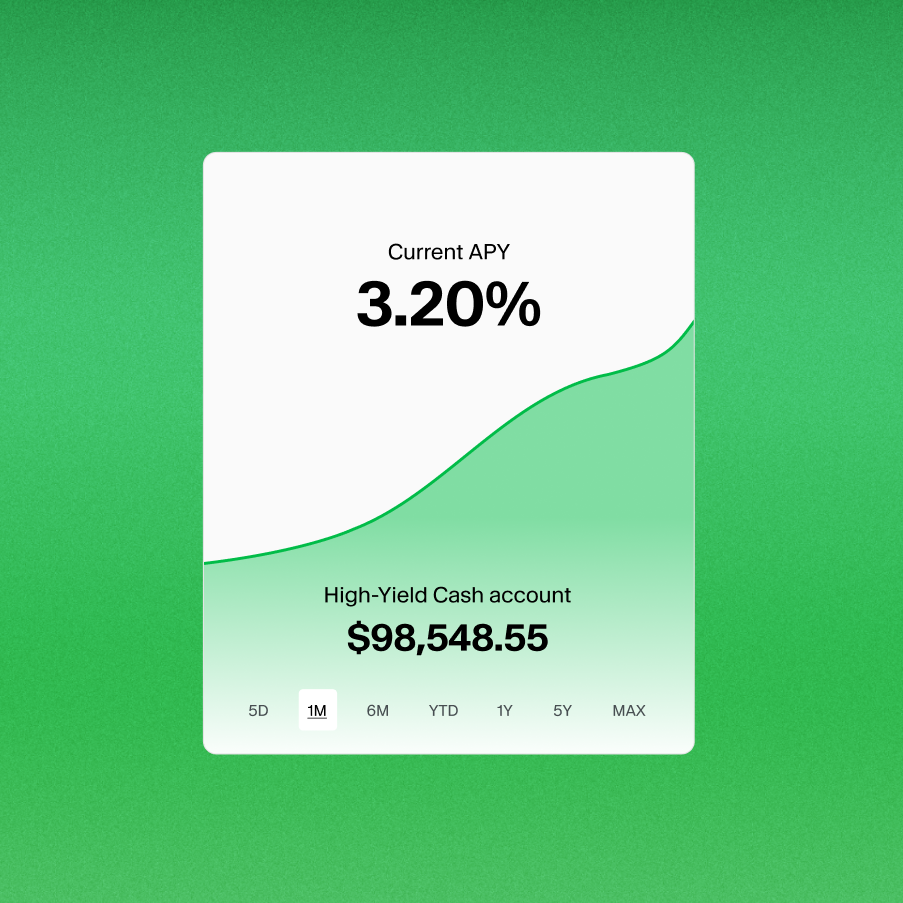

High-Yield Cash Account

Earn

3.20% APY

on your cash.

Up to $3M in FDIC Insurance on individual, trust, and business cash accounts, and up to $6M on joint accounts, through our partner banks.

Altruist Financial LLC is not a bank. APY is variable and subject to change.

Here are 8x reasons to manage your cash in Altruist.

Average savings account

Altruist’s High-Yield Cash

(8x the national average1)

1. The national average interest rate for savings accounts as posted on FDIC.gov, as of January 20, 2026.

And here’s

three more.

Fast account opening.

Enjoy an intuitive setup flow that’s paperless and engineered to get you up and running, quickly.

NEW: Clients can now open and fund accounts on their own, and you’ll receive notifications when an account is opened and when it’s funded.

Easy access.

Clients can access their funds with just a few clicks, ensuring same-day liquidity whenever they need it. You stay in control with visibility into every new account opened.

Big benefits.

Unlimited transfers, zero minimums, easy ACH linking, and no annual fees.

Other fees may apply. Please see the Altruist Financial LLC Fee Schedule on altruist.com/legal to learn more.

Higher yields,

secure and simple.

Put your clients’ cash to work without having to change your investment strategy. Clients can open accounts independently, and you receive real-time notifications so you remain fully in control.

Access FDIC insurance up to $3M across individual, trust, and business cash accounts, and up to $6M across joint cash accounts via our partner banks.

With no minimum balances or annual fees, easy digital onboarding, and powerful back-office automations, it’s never been easier to grow your clients’ cash.

Featured Webinar

How to earn more on cash with Altruist

Product Manager Clare McKee and Product Marketer Nix Puri dive into High-Yield Cash and the opportunity it unlocks.

Frequently asked questions.

What High-Yield Cash Account types can I open for my clients?

You can open individual, joint, trust, and business accounts, and clients can open their own individual and joint accounts at your firm while you manage permissions and receive notifications.

Are there any limits on transfers or withdrawals?

No. Clients and advisors can schedule unlimited transfers, and advisors are notified about all account activity.

Can my clients withdraw cash directly from their High-Yield Cash Accounts?

Yes, clients gain full control over their funds upon opening a High-Yield Cash Account. They can easily link a bank account for ACH deposits and withdrawals through the Client Portal, and access their funds via desktop, or via the Altruist mobile application.

How many High-Yield Cash Accounts can I open per client?

There’s no limit. Open as many as needed, and clients can open their own as well, with you controlling permissions and settings.

Who manages the High-Yield Cash accounts?

You manage all High-Yield Cash accounts on behalf of your clients, including any accounts they open in the app. As part of this role, you may charge fees, move cash into or out of the account, and place restrictions on withdrawals.

Interested in Altruist?

Use our platform to streamline RIA operations, cut overhead costs, exceed client expectations, and deepen relationships.

The Annual Percentage Yield (“APY”) for the High-Yield Cash accounts (“High-Yield Cash”), is variable and may change at any time. The amount of interest you will receive on your deposits will vary based on a number of factors. Accrued interest is paid on the last business day of the month directly into the High-Yield Cash account. View our disclosures to learn more.

High-Yield Cash is offered through a separate account at Altruist Financial LLC (“Altruist Financial”) that is opened solely for participation in High-Yield Cash. Neither Altruist Financial nor any of its affiliates are banks. Altruist Financial deposits cash in the High-Yield Cash account with one or more banks (“Program Banks” see the Altruist Financial LLC Participating Bank List) that accept and maintain such deposits. Through High-Yield Cash, clients’ cash is deposited into Program Banks where the cash earns a variable interest rate and is eligible for FDIC insurance. Cash is not eligible for FDIC insurance until the cash is deposited at the Program Banks. Cash in the High-Yield Cash account that is awaiting to be deposited in, and cash in transit to or from, Program Banks, may not be eligible for coverage under SIPC. SIPC coverage does not apply to cash deposited with Program Banks. FDIC insurance is limited to $250,000 per depositor, per FDIC-insured bank, per ownership category and is subject to conditions. More information can be found in the High-Yield Cash Disclosure Statement and the Altruist Financial LLC Participating Bank List. FDIC insurance only covers the failure of the FDIC-insured depository institution. FDIC coverage can be impacted by several things, including but not limited to deposit capacity at a Program Bank and/or if a client holds cash at a Program Bank, including through this or additional sweep programs. Clients are responsible for monitoring their total assets at each of the Program Banks, whether through Altruist Financial accounts or accounts with other financial intermediaries, to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. For more information on FDIC insurance coverage, please visit FDIC.gov.

Deposits to High-Yield Cash will be deposited with Program Banks on the following business day. Cash deposited via ACH or Check may take three (3) or more business days for the funds to become available for deposit. Customers can initiate withdrawals at any time from the High-Yield Cash account. View our disclosures to learn more.

Clients should carefully review the information provided on altruist.com/legal to determine whether High-Yield Cash is an appropriate product for their specific financial needs. Retail clients must work with a Registered Investment Advisor to open an High-Yield Cash account. Securities trading is not possible in the High-Yield Cash account.