Welcome to Altruist

We make it easier to work with your advisor and achieve your financial goals.

We protect client assets, settle trades, and adhere to a strict set of policy and regulatory requirements. But unlike other custodians, we’ve built a smart, simple platform that gets rid of tedious paperwork and lengthy processes—so you and your advisor can get down to business.

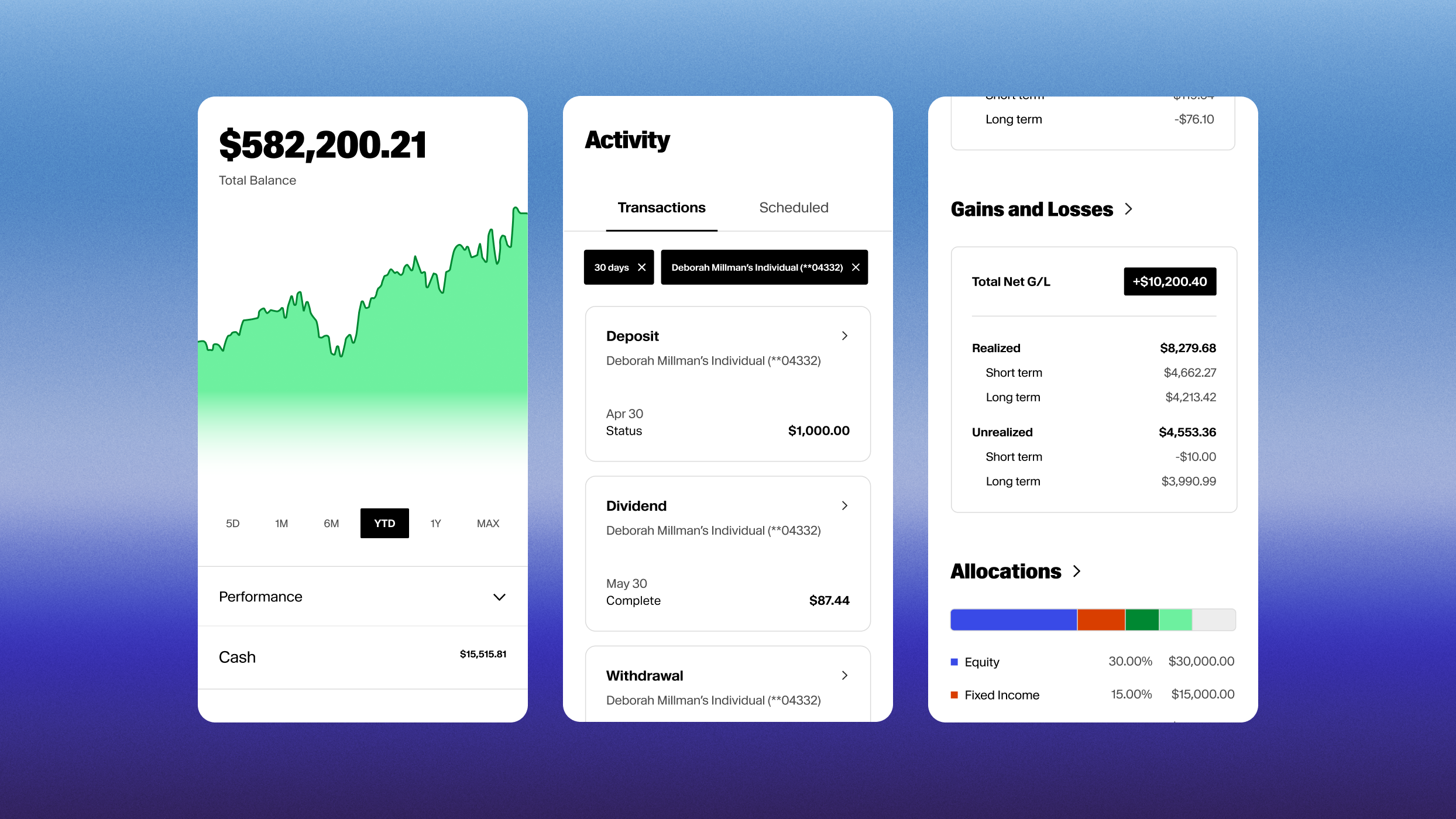

Altruist helps your advisor deliver better outcomes.

Our platform is more than just elegant and easy-to-use. It’s built to create tangible benefits for your portfolio.

Get Compounding Benefits

Smart, digital-first features (like automated rebalancing, tax loss harvesting, and higher yields on cash) can help you reach goals faster.

Work Smarter Together

Simple UI means less back-and-forth and more time actually working with your advisor.

Monitor Your Performance

Track your investment progress, manage your cash accounts, and download documents in only a few clicks.

We keep

assets safe.

We protect your clients’ assets with comprehensive insurance coverage, FINRA and SEC regulation, and other safeguards.

Our tech

is secure.

We use independent auditors to examine our systems and controls to ensure they meet the latest AICPA standards.

We’re built

to last.

We’re built and backed by industry veterans who are focused on achieving consistent, stable growth and long term outcomes.

“

No distractions, no anxiety, so that I can stay focused on my goal right till the very end.”

Beck Bode LLC client & Altruist user

This testimonial was given by a current client. Neither Altruist nor its affiliates paid for this testimonial, but we do earn revenue from financial advisors who use our software, from assets invested through our broker-dealer (Altruist Financial LLC) and assets using services made available by our registered investment adviser (Altruist LLC). The promoting advisor received compensation or other benefits from Altruist through the promoting advisor’s participation in one or more of Altruist’s various programs, which created a conflict of interest on the promoting advisor’s part and may have influenced the view(s) expressed by the promoting advisor. Ben Beck has a personal investment in Altruist Corp which presents a conflict of interest due to them potentially benefitting financially from the company’s success. This relationship may influence their statements. For more details on program compensation and benefits and related conflicts of interest, please visit altruist.com/RIA-testimonial. For additional information about the promoting advisor’s conflicts of interest when expressing its views about Altruist or Altruist’s affiliates, please see the promoting advisor’s advisory program brochures, available at https://adviserinfo.sec.gov/. This testimonial may not represent the experience of others and it is not a guarantee of results.