Back

Use cases

Essential tools on a scalable, open platform.

Product

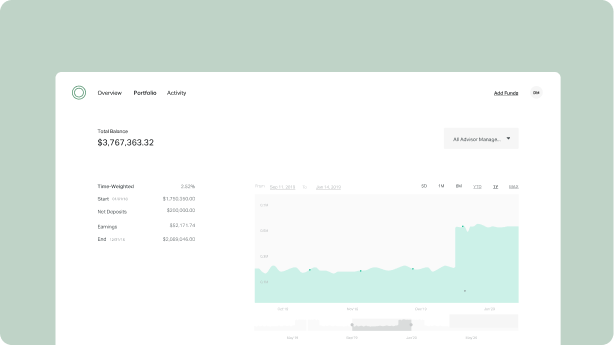

Portfolio Management

Drive better client outcomes

Portfolio Reporting

Present data effortlessly

Model Marketplace

Stop overpaying your TAMP

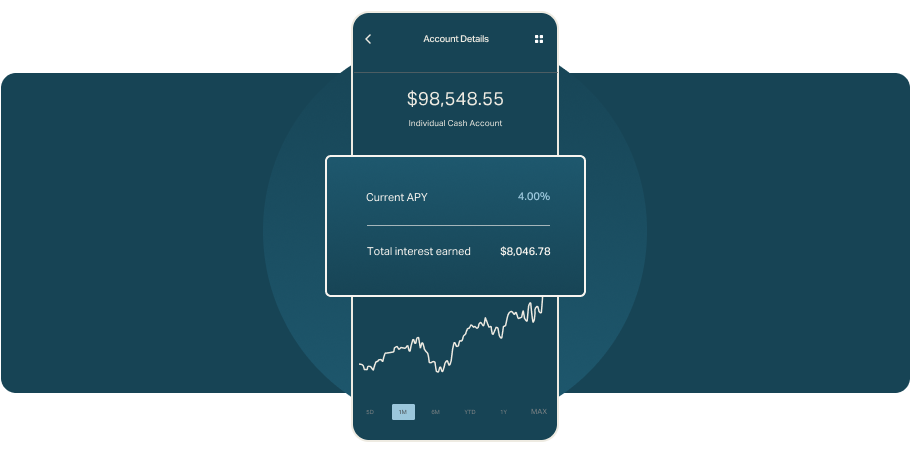

Altruist Cash

Offer industry-leading APY

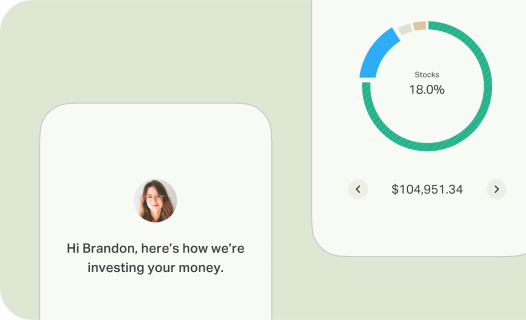

Client Experience

Exceed expectations

Fee Billing

Accommodate any billing arrangement

Advisor Experience

Enjoy a new standard of support

Integrations

Unlock productivity

Clearing and Custody

Eliminate your biggest pain points by partnering with the modern custodian built exclusively for RIAs.

Learn more

Blog

See all blogs

Original content

Get stellar customer service and software — all in one streamlined solution. Explore product

Case study

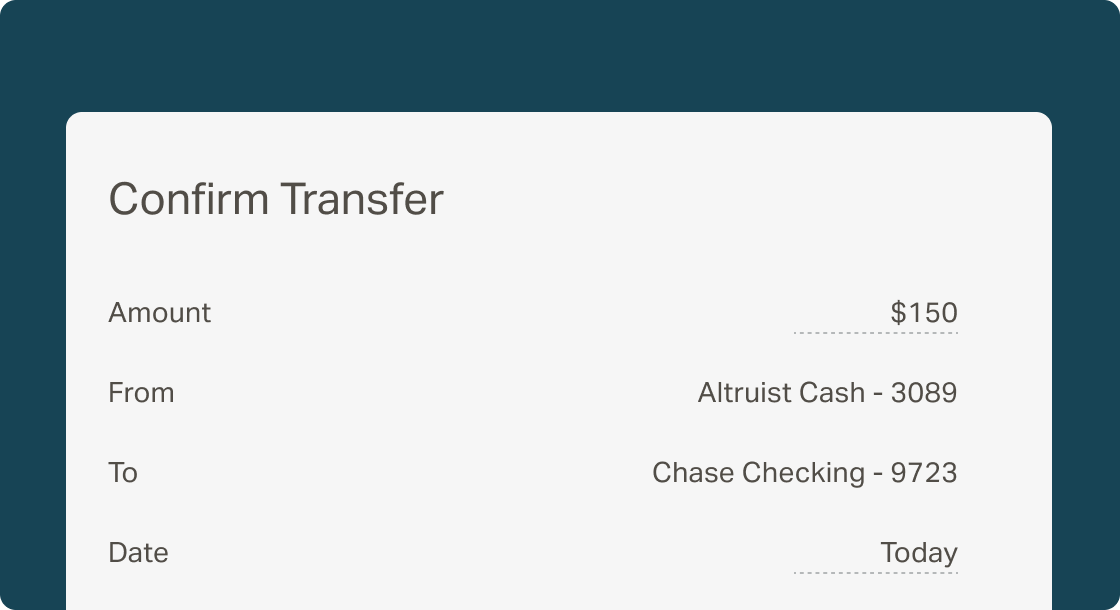

Why Windle Wealth is moving $150m to Altruist

Learn more about DJ Windle's decision to take his business from TDA to Altruist.

See for yourself

Take a self-guided tour

Get time savings and personalization without the 50+ bps price tag. Explore product