We will always be transparent about how we make money. Our income sources align with those of other custodians, encompassing interest income on cash balances, mutual fund transactions and 12b-1 fees, payment for order flow, and revenue from fully paid lending.

Additionally, we provide a Model Marketplace that features over 350 investment models, each employing a variety of strategies. These models carry individual fees, further contributing to our revenue.

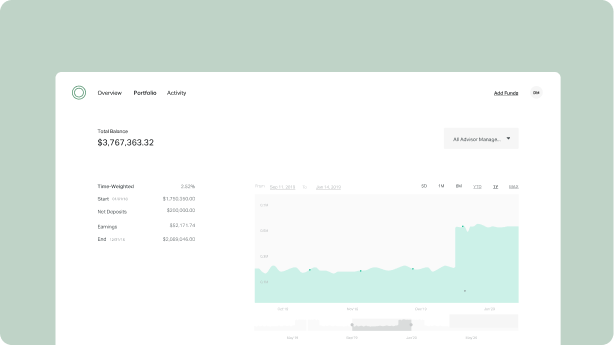

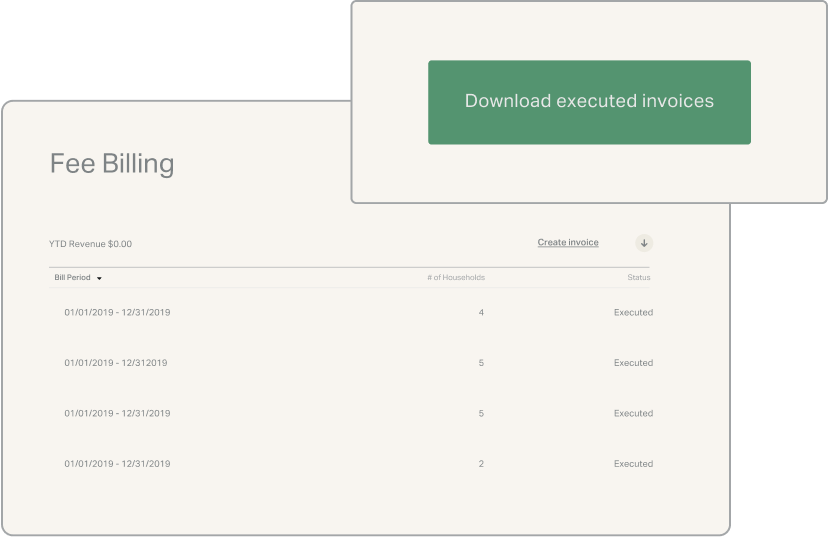

While our Portfolio Accounting Software (PAS) is available at no cost for all Altruist brokerage accounts, enhancing our mission to foster an open platform, we extend our services to advisors using other custodians. For these advisors, utilizing Altruist for portfolio accounting and fee billing incurs a nominal PAS fee of $1 per account monthly, after their initial 100 connected accounts, which are offered free of charge.