High-Yield Cash Account

Earn

4.00% APY

on your cash.

Up to $2M in FDIC Insurance through our partner banks.

Altruist Financial LLC is not a bank. APY is variable and subject to change.

Here are 10x reasons to

manage your cash in Altruist.

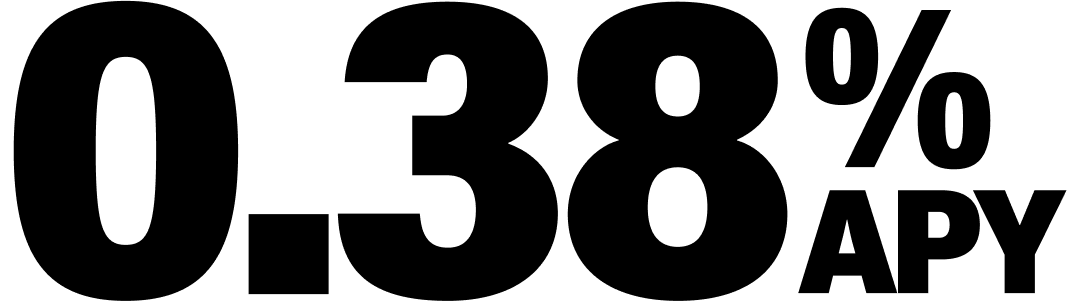

Average savings account

Altruist’s High-Yield Cash

(10x the national average1)

1. The national average interest rate for savings accounts as posted on FDIC.gov, as of June 16, 2025.

And here’s

three more.

Fast account opening.

Enjoy an intuitive setup flow that’s paperless and engineered to get you up and running, quickly.

Easy access.

Clients can access their funds with just a few clicks, ensuring same-day liquidity whenever they need it.

Big benefits.

Unlimited transfers, zero minimums, easy ACH linking, and no annual fees.

Other fees may apply. Please see the Altruist Financial LLC Fee Schedule on altruist.com/legal to learn more.

Higher yields,

secure and simple.

Put your client’s cash to work without having to change your investment strategy.

With no minimum balances or annual fees, access to FDIC insurance through our partner banks*, easy digital onboarding, and powerful back-office automations, it’s never been easier to grow your client’s cash.

*up to $1M for individual and trust accounts and $2M for joint accounts

Featured Webinar

Altruist Cash

Management 101

Watch a video replay with Adam Grealish, Head of Investments, for a deep dive into all things Altruist cash management.

Frequently asked questions.

Do my clients need an existing relationship with Altruist to open

an Altruist High-Yield Cash Account?

Absolutely not. You can open a High-Yield

Cash Account for your client as their first–and

only–account type on Altruist and earn the same 4.00% APY as everyone else.

What High-Yield Cash Account types can I open for my clients?

Altruist offers individual, joint, and trust High-Yield Cash Accounts, giving you the flexibility to meet your clients’ diverse financial goals.

Are there any limits on transfers or withdrawals?

There are no limits to how many transfers clients can schedule with our High-Yield Cash Accounts.

Can my clients withdraw cash directly from their High-Yield Cash Accounts?

Yes, clients gain full control over their funds upon opening a High-Yield Cash Account. They can easily link a bank account for ACH deposits and withdrawals through the Client Portal, and access their funds via desktop, or via the Altruist mobile application.

How many High-Yield Cash Accounts can I open per client?

There’s no limit. Open as many High-Yield Cash Accounts as needed to help your clients manage their cash. You can even nickname the accounts for different purposes.

Interested in Altruist?

Use our platform to streamline RIA operations, cut overhead costs, exceed client expectations, and deepen relationships.

The Annual Percentage Yield (“APY”) for the High-Yield Cash accounts (“High-Yield Cash”), formerly Altruist Cash, is variable and may change at any time. The amount of interest you will receive on your deposits will vary based on a number of factors. Accrued interest is paid on the last business day of the month directly into the High-Yield Cash account. View our disclosures to learn more.

High-Yield Cash is offered through a separate account at Altruist Financial LLC (“Altruist Financial”) that is opened solely for participation in High-Yield Cash. Neither Altruist Financial nor any of its affiliates are banks. Altruist Financial deposits cash in the High-Yield Cash account with one or more banks (“Program Banks” see the Altruist Financial LLC Participating Bank List) that accept and maintain such deposits. Through High-Yield Cash, clients’ cash is deposited into Program Banks where the cash earns a variable interest rate and is eligible for FDIC insurance. Cash is not eligible for FDIC insurance until the cash is deposited at the Program Banks. Cash in the High-Yield Cash account that is awaiting to be deposited in, and cash in transit to or from, Program Banks, may not be eligible for coverage under SIPC. SIPC coverage does not apply to cash deposited with Program Banks. FDIC insurance is limited to $250,000 per depositor, per FDIC-insured bank, per ownership category and is subject to conditions. More information can be found in the High-Yield Cash Disclosure Statement and the Altruist Financial LLC Participating Bank List, both available on altruist.com/legal. FDIC coverage can be impacted by several things, including but not limited to deposit capacity at a Program Bank and/or if a client holds cash at a Program Bank, including through this or additional sweep programs. Clients are responsible for monitoring their total assets at each of the Program Banks, whether through Altruist Financial accounts or accounts with other financial intermediaries, to determine the extent of available FDIC insurance coverage in accordance with FDIC rules. For more information on FDIC insurance coverage, please visit FDIC.gov.

Deposits to High-Yield Cash will be deposited with Program Banks on the following business day. Cash deposited via ACH or Check may take three (3) or more business days for the funds to become available for deposit. Customers can initiate withdrawals at any time from the High-Yield Cash account. View our disclosures to learn more.

Clients should carefully review the information provided on altruist.com/legal to determine whether High-Yield Cash is an appropriate product for their specific financial needs. Retail clients must work with a Registered Investment Advisor to open an High-Yield Cash account. Securities trading is not possible in the High-Yield Cash account.