Now Offering Securities-Based Lines Of Credit

Cash when your

clients need it

with SBLOC.

All dashboard information is for informational purposes only.

The flexible, low-interest way to

offer liquidity to your clients, while

keeping their investments working.

No need to liquidate securities, alter the investment strategies you’ve already created, or trigger capital gains. Just flexible loans, brought to you by TriState Capital Bank—for that down payment, kitchen renovation, and whatever else your clients need to live their best lives.

Benefits of choosing SBLOC with Altruist

Low interest rates.

Secure loans with highly competitive, industry-leading interest rates, like a Secured Overnight Financing Rate (SOFR) of +2.00%*.

*Rates shown are for illustrative purposes only. Actual rates will vary based on line size, collateral type, market conditions, and credit approval. All rates are subject to change without notice.

Flexible terms.

Easily customize loan terms to fit your client’s exact financial needs—set personalized timelines, repayment schedules, and more.

No setup fees.*

Skip setup fees and draw fees—receive loans free of extra costs, when your clients need them.

*Other fees may apply including wire fees (charged by sending or receiving banks) that are required. View the Altruist Financial LLC Fee Schedule for additional information.

Altruist X TriState

We’re bringing you SBLOC supported by the highly reputable private bank, TriState Capital Bank. Like us, TriState Capital Bank is known for their reliability, quick processing, and exceptional customer service. Our lending relationship choice was clear when we saw their competitive interest rates, flexible loan terms, and customer satisfaction history.

How to begin:

Step 1: Apply.

Apply for a loan through the TriState Capital Bank’s Digital Lending Platform (DLP).

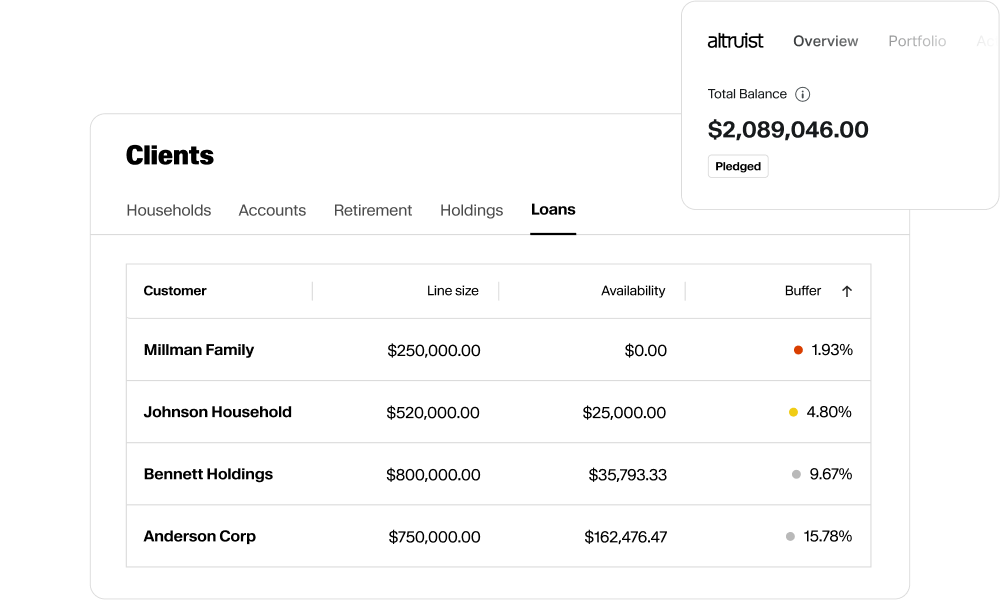

Step 2: Get full visibility of loan details on Altruist.

Once approved, loan details and tracking for pledged accounts will be displayed on your Altruist portal, alongside other managed assets.

Step 3: Manage loans easily through the TriState platform.

Draw capital, manage repayments, and customize loan terms through your TriState Capital Bank’s DLP.

Frequently asked questions.

Are there minimums?

Yes. The minimum loan amount you can borrow from TriState Capital Bank is $250,000. In certain cases, TriState Capital Bank may consider smaller loan amounts. Advisors should reach out to TrisState Capital Bank directly for details.

What can clients use SBLOC for?

Securities-Based Lines of Credit (SBLOC) can be used for a wide range of financial needs. Common use cases might be a down payment, home renovations, luxury purchases, tax obligations, weddings, and other large life expenses. SBLOC provides cash to clients without disrupting their investment strategies.

What asset types and accounts are eligible and ineligible?

Eligible: Non-retirement assets such as stocks, bonds, mutual funds, and ETFs.

Certain asset types are ineligible for use as SBLOC collateral, including:

- Retirement accounts (e.g., IRAs, Roth IRAs, 401(k)s, 403(b), 457 plans)

- Margin accounts

- Annuities and insurance products

- Liquid or restricted securities (e.g., private placements, restricted stock)

- Mutual funds with redemption restrictions

- UTMA / Minor Accounts

- 529 Accounts

How long does approval take, and what documentation is required?

Once all documents are submitted, approvals typically take a few business days. Required documentation includes:

- Completed application form

- Holdings statement (no more than 60 days old)

- Client photo identification

- Additional documents may be required for trusts or business entities.

Are there any hidden setup fees?

No, there are no setup fees, or draw fees*. And that’s on purpose.

*Other fees may apply including wire fees (charged by sending or receiving banks) that are required. View the Altruist Financial LLC Fee Schedule for additional information.

How do withdrawals work?

Withdrawals require a collateral release letter through the TriState Capital Bank’s Digital Lending Platform. Processing time can vary from same-day to a week. Funds are delivered via ACH or wire.

Explore our entire platform, custom built for RIAs.

Modern

times call

for a modern custodian.

Use our platform to streamline RIA operations, diminish overhead costs, exceed client expectations, and deepen relationships.

Securities-based lending is a non-purpose margin loan secured by eligible, marketable securities. It is non-purpose because the proceeds of the line of credit cannot be used to purchase or carry securities. Securities-based lending has special risks and is not suitable for all investors. The risk of securities-based lending include: (i) market fluctuations that may cause the value of pledged assets to decline, (ii) a decline in the value of the pledged securities that could result in selling the securities to maintain equity, and (iii) possible adverse tax consequences as a result of selling securities. Fluctuations in market interest rates could also affect the applicable index rate that applies to your line of credit causing the cost of the credit line to increase significantly. The interest rates charged on lines of credit backed by securities are determined in part by the line of credit amount as outlined in the loan documents. If market conditions change to the detriment of the account holder, he or she may be required to deposit additional securities and/or cash in the account or pay down the loan to avoid liquidation of securities. Securities in pledged collateral accounts may be sold to meet collateral calls; and the Bank may order the custodian to sell the account holder’s securities without contacting them in advance. An account holder may not be entitled to choose which securities or other assets in his or her account are liquidated or sold to meet a collateral call, and an account holder may not be entitled to an extension of time on a collateral call. All rates, terms and products are subject to change, availability, or discontinuation without prior notice. Other terms, restrictions, and fees may apply. All extensions of credit and collateral are subject to credit review and approval. Past performance and outlooks are not indicative, or a guarantee, of future results.

All rates, terms and products are subject to change, availability, or discontinuation without prior notice. Other terms, restrictions, and fees may apply. All extensions of credit and collateral are subject to credit review and approval. Past performance and outlooks are not indicative, or a guarantee, of future results.

The Digital Lending Platform (DLP) is a digital platform offered exclusively by TriState Capital Bank.

Altruist Financial LLC and its affiliates are not banks. Loans are offered through TriState Capital Bank, a Pennsylvania-chartered bank.