What can advisors expect?

Altruist acquired SSG in March 2023 in an effort to accelerate a shared mission – to make financial advice better, more affordable, and accessible to everyone.

Advisors using SSG’s custodial services should expect business as usual with zero disruption to existing services.

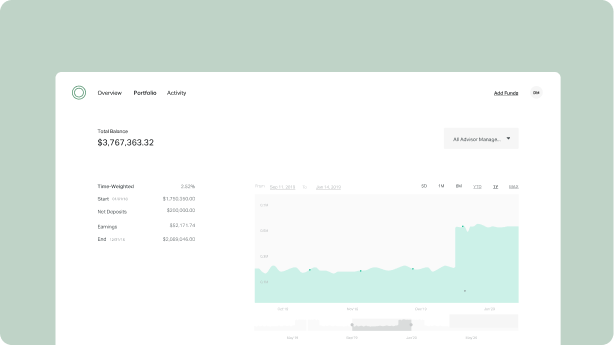

The merger provides numerous benefits for advisors including expanded customer support, modern practice management software, and continuous innovation for independent financial advisors.