What can you expect?

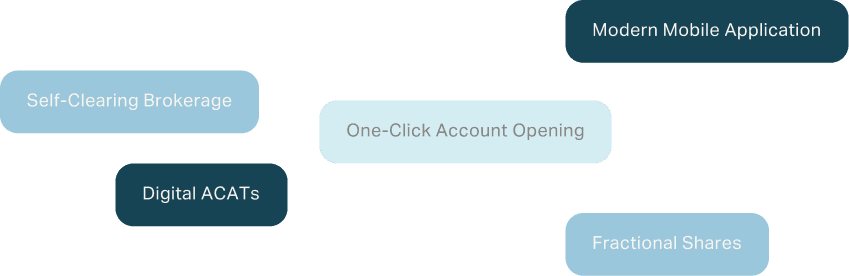

Like much of Altruist’s functionality, the process will be fully digital and easy for clients and advisors -- clients won’t have to sign new paper forms, assets and cash remain insured by SIPC*, and we are empowered to deliver more innovation to RIAs, significantly faster. Timelines, FAQs, and additional resources can be found below.

*Member of SIPC. Securities in your account protected up to $500,000. For details, please see www.sipc.org.